Insurance – You need someone you can rely on

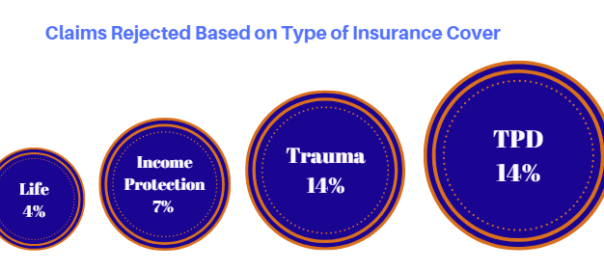

The Australian & Securities Investment Commission (ASIC) have outlined the level of insurance claims which are declined each year by insurers:

ASIC revealed those who implemented their insurance via an adviser had a higher percentage of claims approved compared to an individual who purchased a policy direct from the insurer.

The value of obtaining advice when seeking to protect yourself and your family against the unthinkable should never be underestimated. The levels of insurance cover regularly run into the millions, and our clients are often surprised of how financially exposed they are should death, illness, or injury occur.

We are talking big numbers here, and when it comes to protecting your family, professional advice should always take precedence.

Without professional advice it can be very difficult to determine the level of cover required, which insurer to use, how the policy should be owned, and which type of premiums to select. Add to that going through the application and medical process it’s no revelation that many Australians are under-insured, especially those who choose to implement the insurance themselves.

In many cases, were it not for the adviser, those clients would likely either not start the process, or give up part way through.

In many cases, were it not for the adviser, those clients would likely either not start the process, or give up part way through.

There is a lot of value that advisers add to the insurance process, however in our experience, helping a client through an insurance claim is where we make the biggest difference.

We have had an unfortunate number of our clients claim on their insurance policies over the years. These have been due to death, permanent disablement where the client was unable to ever return to work, as well as a large number of claims due to cancer, and other illness / injuries where those clients were unable to work for a period of time.

Almost all of these client’s said the same thing to us upon receiving their claim payments, ‘there is no way I could have completed the claims process without you’.

There are a number of reasons for that. Claims require medical and sometimes financial evidence to be provided, and the forms can get quite technical. Paperwork isn’t fun at the best of times, but when a family is dealing with serious illness or death, it’s good to have the professional support of a Trusted Adviser.

We at JBS know we play a critical role in developing a protection strategy, and our true value shines through when a claim occurs.

It’s comforting for our clients to know they can rely on JBS to provide appropriate insurance advice, and be there to provide comfort, support, and take the pressure off at a very challenging period in a client’s time of need.

When it comes to insurance advice and claims, that’s the type of reliability you want.