What personal insurance does an everyday Australian have?

As long as you’re an Australian resident, you will have some form of personal insurance through Government agencies and bodies such as Centrelink, TAC and WorkCover. Often when asked about personal insurance cover, most people would simply suggest they have automatic cover through Work and their superannuation funds. There are several main concerns here. Firstly there are many misconceptions about what types of covers are offered by government organisations. For instance workcover will only cover you if you get injured at work and not if you injure yourself during out of work hours. Secondly people misunderstand the conditions which needs to be met before the insurance companies accept the claim. Lastly the cover amount may not be sufficient. For example work cover will only cover death for up to the maximum amount of $611,430 per person, which wouldn’t be sufficient if that person happens to have $700,000 of debt.

Let’s firstly have a look at the disability pension through Centrelink. To be eligible you must firstly be between ages 16 to pension age, pass the residency requirements and meet the income / asset test. Once you’ve met all these conditions your disability will then be assessed. To meet the disability requirement, you must be either permanently blind or assessed to be physically / mentally impaired and unable to work for more than 15 hours or more per week for the next 2 years. Furthermore you may be required to participate in support programs going forward. In other words your disability or condition must be very severe and permanent for you to receive support from Centrelink. Then there’s the NDIS (National Disability Insurance Scheme), which again is run by the government for anyone who suffers permanent disability such as permanent blindness, Down syndrome and autism. The biggest misconception regarding what the NDIS offers is the fact that NDIS does not offer monetary support, but rather provides aids and equipment to anyone who is eligible.

Let’s firstly have a look at the disability pension through Centrelink. To be eligible you must firstly be between ages 16 to pension age, pass the residency requirements and meet the income / asset test. Once you’ve met all these conditions your disability will then be assessed. To meet the disability requirement, you must be either permanently blind or assessed to be physically / mentally impaired and unable to work for more than 15 hours or more per week for the next 2 years. Furthermore you may be required to participate in support programs going forward. In other words your disability or condition must be very severe and permanent for you to receive support from Centrelink. Then there’s the NDIS (National Disability Insurance Scheme), which again is run by the government for anyone who suffers permanent disability such as permanent blindness, Down syndrome and autism. The biggest misconception regarding what the NDIS offers is the fact that NDIS does not offer monetary support, but rather provides aids and equipment to anyone who is eligible.

Now let’s have a look at the covers offered through WorkCover and TAC. Workcover provides insurance cover for all working Victorians. Each state has their own body, which operate similarly. Both WorkCover and TAC operate on a no fault policy meaning you will be covered at work or on the roads, even if it’s your fault that led to your injury / disability. The main consideration here is that you have to be either at work or on the roads, at the time of the incident. Furthermore it’s important to note that there are limits on how much WorkCover and TAC will payout in the event of death, total disablement and income supplement.

The last type of insurance we will look at is the default cover offered by our superannuation companies. For those of us who have super accounts will also have personal insurance cover attached. There are generally 3 types of insurance offered by industry super funds. Death / TPD or Income Protection. Depending on your super fund you may either have all 3, just one of them or none. Although generally more cheaper to fund, it’s important to point out that default insurance through super funds are very general and will most likely be on reduced cover, meaning the amount insured will reduce over time. This is exactly what you don’t want considering as we get older the chances of us claiming on insurance increases, whilst on the other hand the default cover is reducing on an annual basis.

So here’s a question. If you suffered a heart attack or stroke and required large sums of money for treatment, which of the above insurance covers will pay? The answer is none of them. Overall most of us will have access to some form of default personal insurance. It’s important to understand that these default covers in most cases will not provide you with adequate cover. Having a personalised insurance policy is crucial as it will provide you with customised insurance cover to meet your specific needs.

If you are unsure about what insurance you currently have or would like to review your insurance, please get in touch with the team at JBS to ensure you have the right cover in place.

One of the first things retirees quickly discover is that they have too much time on their hands with nothing to do. Playing a round of golf with mates or enjoying a drink at the bar will only fill up a certain amount of time in the day and you can’t go doing the same thing every day. Retired couples and singles alike will quickly become very unhappy once they run out of things to do.

One of the first things retirees quickly discover is that they have too much time on their hands with nothing to do. Playing a round of golf with mates or enjoying a drink at the bar will only fill up a certain amount of time in the day and you can’t go doing the same thing every day. Retired couples and singles alike will quickly become very unhappy once they run out of things to do.

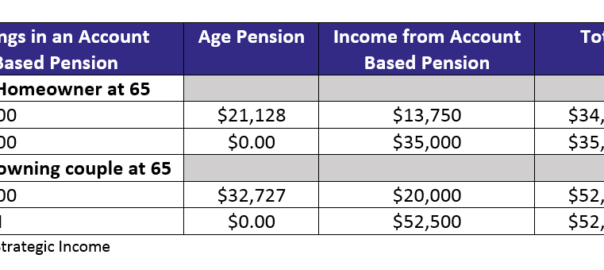

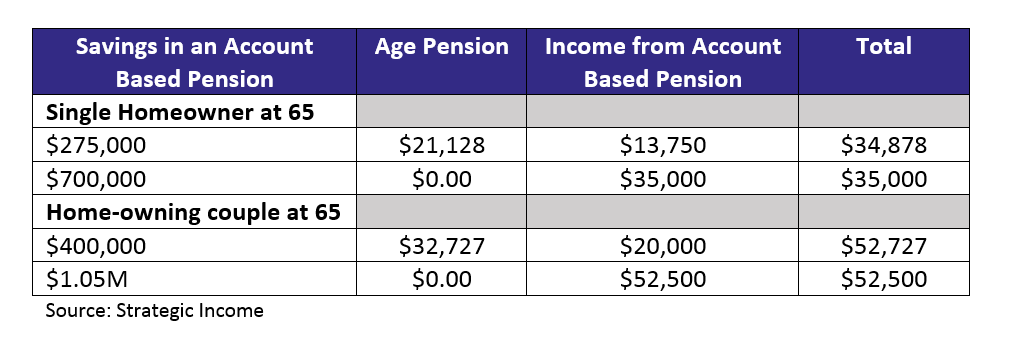

Unfortunately for some, the Age Pension will be critical to fund their retirement, but the Age Pension age doesn’t need to be your Retirement Age. There’s a few things you can do to help reduce your reliance on the Age Pension and retire when you want to retire, our motto is that we’d rather you be working because you want to, not because you have to.

Unfortunately for some, the Age Pension will be critical to fund their retirement, but the Age Pension age doesn’t need to be your Retirement Age. There’s a few things you can do to help reduce your reliance on the Age Pension and retire when you want to retire, our motto is that we’d rather you be working because you want to, not because you have to.

Since July 1 2017, the ten percent employment rule regarding tax-deductible super contributions has been replaced. The rule meant that a person could not claim a tax deduction on personal Super Contributions if more than ten percent of their assessable income was obtained as an employee. The new rule is now any person under age 65 now may be able to claim a tax deduction on their contributions regardless of their employment arrangement, whilst those aged between 65 and 74 need to satisfy the Work Test in order to be eligible to make a contribution, and subsequently claim a tax deduction.

Since July 1 2017, the ten percent employment rule regarding tax-deductible super contributions has been replaced. The rule meant that a person could not claim a tax deduction on personal Super Contributions if more than ten percent of their assessable income was obtained as an employee. The new rule is now any person under age 65 now may be able to claim a tax deduction on their contributions regardless of their employment arrangement, whilst those aged between 65 and 74 need to satisfy the Work Test in order to be eligible to make a contribution, and subsequently claim a tax deduction.

With all the festivities and celebrations over and done with, for most of us it’s now time to pick up the pieces and start the New Year a fresh, which is a perfect time to review your personal insurance needs. Research from one of Australia’s largest personal insurance companies have found that only 37% of Aussies aged between 18-69 actually have life insurance and even more disturbingly only 18% have disability cover and income protection insurance. Further findings include how Australians are grossly underinsured. It’s estimated that the underinsurance gap in Australia is approximately $1.8 Billion, meaning there are a lot of Aussies out there who believe they have sufficient insurance cover, but in fact don’t. For most of us, we don’t like to think about insurance and when asked about how much we have, the first response is usually “I don’t know”.

With all the festivities and celebrations over and done with, for most of us it’s now time to pick up the pieces and start the New Year a fresh, which is a perfect time to review your personal insurance needs. Research from one of Australia’s largest personal insurance companies have found that only 37% of Aussies aged between 18-69 actually have life insurance and even more disturbingly only 18% have disability cover and income protection insurance. Further findings include how Australians are grossly underinsured. It’s estimated that the underinsurance gap in Australia is approximately $1.8 Billion, meaning there are a lot of Aussies out there who believe they have sufficient insurance cover, but in fact don’t. For most of us, we don’t like to think about insurance and when asked about how much we have, the first response is usually “I don’t know”.