Worst Time To Invest

What if you only invested at market peaks?

Have you ever noticed that as soon as you buy an investment it tends to drop in value? Whilst this doesn’t really always happen, it just tends to be the investments we remember, what if it did happen? Even worse, what if it dropped by epic proportions?

Meet Tim who is the worst market timer that has ever existed. What follows is Tim’s tale of terrible timing of his stock purchases.

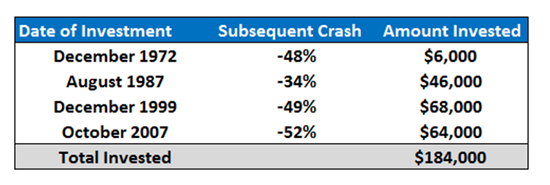

Tim, fresh out of school, begins his career in 1970 at age 18. He understands the importance of investing and saving for the future and therefore decides to start allocating $2,000 per year into a savings account. It’s now the end of 1972 and he has saved up $6,000. Into the stock market it goes. Unfortunately for Tim, after watching the stock market go up and up over the last two years, over the next two years it drops 48%. Tim loses a bit of confidence in the market and while he doesn’t sell, he continues to save up his money in a bank account waiting for things to improve.

15 years later and Tim decides that now is the right time to put more money into the market. It has been going up for years and he sees no reason why it won’t continue. He invests his entire $46,000 into the market. After a small decrease the market then drops suddenly on the 19th of October dropping a whopping 27% in one day. Tim’s had enough, no more putting money into the market. He leaves what is already in there as what’s the point in selling now and goes back to saving in his bank account.

After ignoring the market for 12 more years Tim can’t avoid people talking about the internet. Everyone is making money from the internet. Unfortunately Tim knows very little about the internet but the media informs him that there are plenty of companies on the stock market that do. He takes his $68,000 that he has in the bank and jumps in but this time decides to not even look at the market for the next two years. 2 years later he checks his investment and it have once again decreased by 50%.

It’s 2007 and Tim is now 55. He’s looking to retire in 2013 and decides he’s going to have one last dig at this share market thing. He’s managed to save up $64,000 and into the market it goes. Little does Tim know that once again he’s picked a terrible time to invest, the GFC is about to commence with losses of over 50%.

That’s it, no more investing for Tim…..ever! Once again he leaves the funds in the market but saves up another $40,000 in cash before he retires. So what did he end up with at retirement?

Over his working life Tim has managed to invest $184,000 saving an additional $40,000 over the last few years in cash giving a total investment amount of $224,000. Sure he picked the absolute worst times to invest including the bear market in the early 70’s, the infamous one day crash in 87, the technology bust in 2000 and the GFC in 2007. But he never went back on his investment decisions; he never sold any investments.

Tim ended up with a total retirement balance of $1.1 million. While Tim was a terrible market timer, he was a good investor. He saved a regular amount on a regular basis no matter what. He didn’t panic when the market went down and sold his investment. Instead he maintained his investments until he needed the money. Finally, he invested for the long term and even though he pretty much picked the top of the market each time to put the money in, over time the market continued to go up in value, even if he had to wait a little while after the big falls for it to recover, it always did recover and then go on to meet a new high.

We are not recommending anyone follow Tim’s strategy. He didn’t include diversification in his investment product options and if he would have implemented a dollar cost averaging strategy where he contributed his savings amount each year no matter what, he would have ended up with over twice as much.

This is based on a study in the US, given US market investments however Australian markets felt the same crashes and still illustrates the importance of standing strong with your investment decisions. Time in the market is more important than timing the market.

So what can we take out of Tim’s fictional experience?

1. Losses happen and are part of the deal when investing in the share market. It’s how you react to those losses that will determine your investment performance over time.

2. Invest for the long term and let compound interest work for you.

3. The biggest factors when determining growing your wealth are time, and savings amount. The effect of the actual returns the investments generate on your portfolio pale in comparison to how much money you contribute and how long you invest. Get these two things right, and the rest will follow.

If you are thinking about investing or want to learn more about how you can start your investment portfolio, contact one of the advisers at JBS.