Affording Retirement Expenses

There are several different factors that determine how much you can afford to spend in retirement. Some of them are investment markets, super balance and lifestyle changes. One step that people generally procrastinate, which is important in their retirement planning, is figuring out how much is needed to spend in the various stages of retirement.

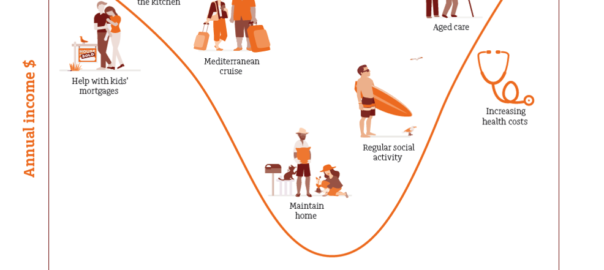

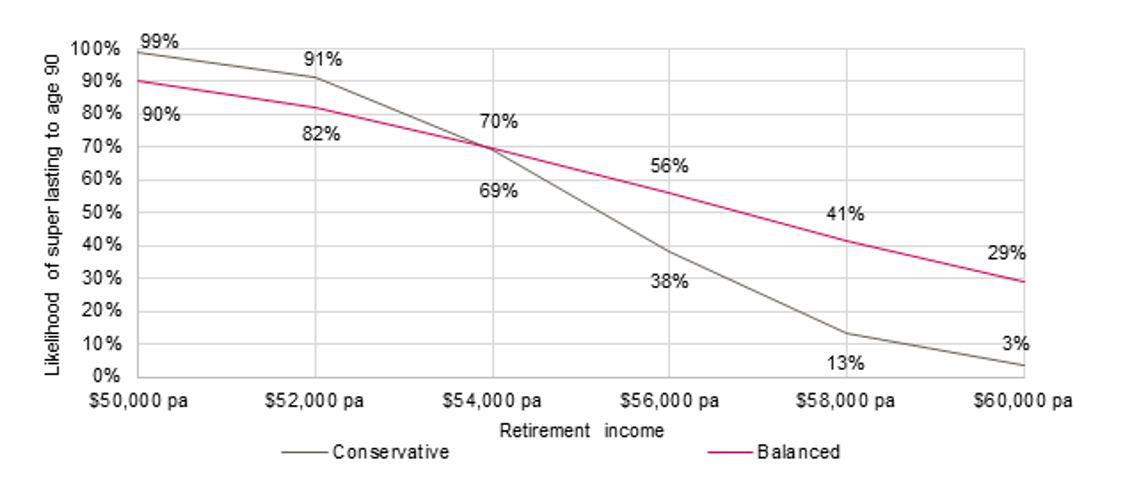

The below chart shows how retirement spending can change over time

Once a desired level of spending is determined, having a good draw-down strategy in retirement allows you to balance your expenses, savings and the way in which the retirement savings are invested.

A good draw-down strategy may allow you to balance the following objective.

1. Maintain a stable and comfortable standard of living in retirement

2. Maximise your Age Pension and any other potential social security benefits

3. Protect the value of your savings against being eroded by inflation and adverse market conditions

4. Provide you with access to your savings to pay for unplanned expenses (without significant penalties for early withdrawal of your capital), and

5. Minimise the risk that you will outlive your wealth, at least for essentials

Case Study

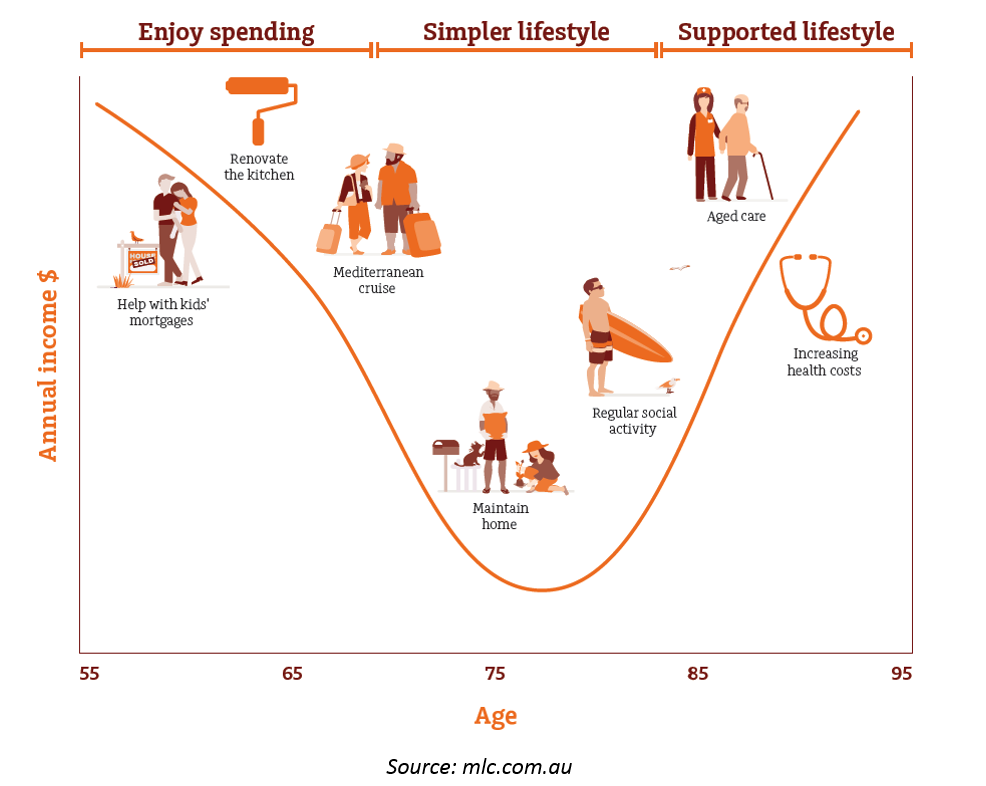

Consider a 65-year-old retired couple who has combined superannuation assets of $500,000 and want to make their savings last 25 years. The below chart shows the impact of different spending strategies for two of the most common account-based pension (ABP) investment portfolio options – conservative and balanced.

If the couple adopted a spending strategy of $50,000 per year, they have at least a 90% likelihood of success for both options (that is, their superannuation assets lasting at least 25 years).

Alternatively, if they spend $56,000 annually, the likelihood of success drops to 56% with the balanced option and 38% with the conservative option. The balanced option has a higher likelihood of success, due to its larger allocation to growth assets. This increases the portfolio’s expected level of both long-term returns and risk. In contrast, the conservative option is made up of more defensive assets.

Impact of spending strategy and investment option on likelihood of super lasting to age 90

Note: Includes the couple’s hypothetical Age Pension entitlements. Results reflect the superannuation and Government Age Pension rules applicable from 1 July 2017.

Source: Willis Towers Watson

What can you do to achieve your desired retirement lifestyle?

It’s important to have a spending and investment strategy in place that is flexible enough to respond to a variety of factors and risks, including the changing patterns of your retirement income needs. Unexpected lump sum expenses, external influences on retirement savings (e.g. adverse market movements) and regulatory changes must be considered.

It is good to have a trusted financial adviser who understands your retirement needs and can help you to make decisions about your investments in the future. We can help you through this process, so feel free to reach out to us.

Start with a Budget: if you haven’t tracked your spending for a while, it is likely that your income and expenses have changed. There is potential for you to save money by simply making a few small adjustments.

Start with a Budget: if you haven’t tracked your spending for a while, it is likely that your income and expenses have changed. There is potential for you to save money by simply making a few small adjustments.