Where do we stand with our finances since COVID hit?

Everyone in Australia has been affected by the COVID pandemic to some degree. With the disruption to our work and social lives, it’s one of the biggest changes many of us have ever faced. But what has it meant for our money and financial wellbeing?

Nearly half of Australians are struggling

A recent survey found that four in ten Australians have lost income because of COVID-19 and are either struggling to make ends meet (11 per cent) or dipping into savings to get by (31 per cent).

What we’re worried about: jobs, savings and super

In spite of the JobKeeper payments supporting businesses to keep employees on the payroll, job insecurity is the number one concern for Australians right now. Women are far more likely to be worried about losing their job (40 per cent compared to 29 per cent for men), and the vast majority of 18 to 24-year old’s (81 per cent) are worried about becoming unemployed.

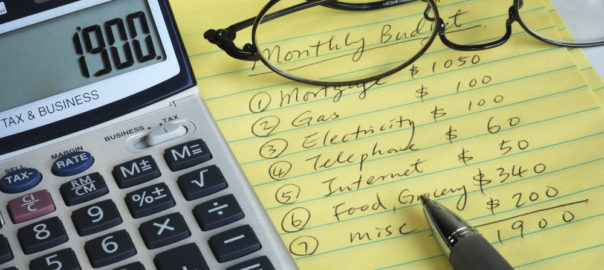

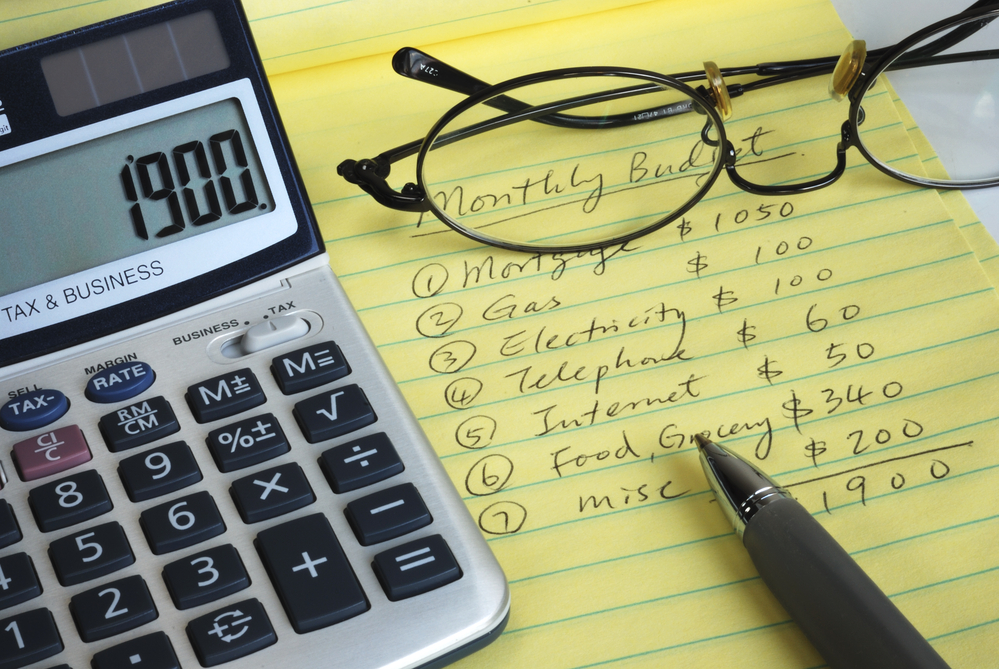

What we regret: budget basics

For most Australians, the COVID events of 2020 have been a wake-up call for their financial habits and behaviours. With 70 per cent of Australians surveyed saying they could have done better or different to improve their financial position, it seems we’ve learnt an important lesson about being financially prepared for the unexpected.

The good news is that these ‘regrets’ are helping us reconsider our financial priorities. When asked about changes they’re willing to make post-COVID, survey respondents ranked “be more frugal about my lifestyle choices” first, followed by “pay down debts” and “create a budget to understand what I’m spending and saving.”

Three ways to look after your financial future

Acting on these good intentions is certainly going to be important for many Australians, especially those having to manage on less income. If you’re feeling more uncertain about your job, income and financial future because of COVID, here are some simple steps you can take to start a long-term commitment to better financial outcomes:

-

Start a ‘COVID-proof’ plan.

Take this as an opportunity to harness positive financial habits you’ve picked up during COVID. Prepare a list of expenses you don’t need any more and another list of how you could use this money to meet your current needs or look after your future – by saving, investing or paying down debts for example. By keeping a COVID mindset even after COVID is over you can make a lot more progress towards your financial and life goals.

-

Think ahead

Work out where you want to be financially in the future – think five years, 10 years, or retirement. Then work backwards for how to get there, along with a timeline of the important milestones you’re looking forward to along the way.

-

Make an appointment with a qualified financial planner

Understanding your current financial situation and short and long-term financial goals – having a financial plan – means you can better manage your finances. Knowing you’re taking care of your immediate expenses, without compromising on saving for the future allows you to live your today while making sure your tomorrow is planned.

Financial advice makes a difference

The people surveyed who have worked with a financial planner have experienced positive outcomes as a result of their advice. One in five have engaged a financial planner and have experienced less impact to their finances compared with others who had not received advice. Almost all of them (87 per cent) did not need to access their super early.

Australians who’ve planned for tomorrow experience greater peace of mind and wellbeing today. They are clearer on what they can spend and save and will sleep peacefully at night knowing that they have someone there to help them understand it all.

If you would like to discuss how you can manage your finances through this crisis, reach out to the JBS Financial to help to discuss your situation.

Source: Money and Life