The Age Pension Myth

An article on moneymag.com.au cited that “retirees with modest savings can be better off than those with more than twice as much”. The argument was that due to the new age pension rules introduced in January 2017, there was a ‘sweet spot’ where the income from the age pension and the return from your pension savings would be equal to the income received by someone with more savings who would not qualify for the age pension.

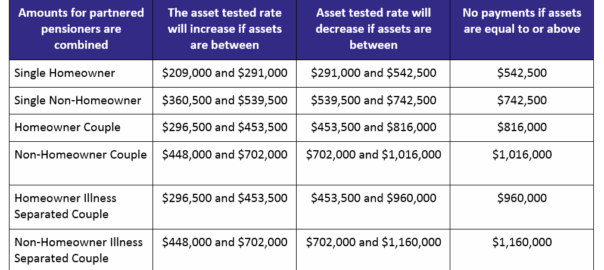

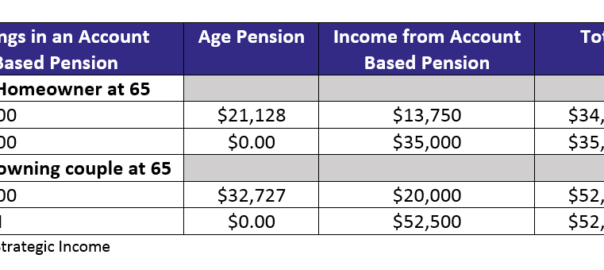

The below table sets out the results.

The assumption was that you would take the minimum amount from your pension account and combine it with your age pension entitlement. As you can see a couple with $1,050,000 will have the same amount of income as a couple with $400,000. What the analysis conveniently doesn’t include however is the capital value. It also only looked at 1 year and did not take into account what would happen in future years.

From a very simplistic view, lets assume that no capital is being drawn in either scenario and hence the capital values remain the same. This means that when the retirees die, they will have $605,000 more money available to pass onto their beneficiaries than in the scenario where the couple only has $400,000. Yes, the income is the same but the actual wealth is way different.

A second and more complicated scenario outlining how the person with more money is in fact way better off is if the capital is drawn down. Let’s assume an extra $10,000 per year, with an earnings rate within the pension account of a modest 5%.

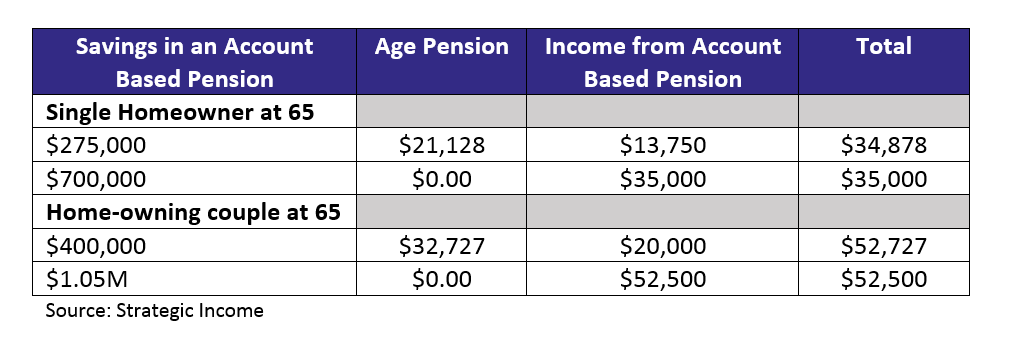

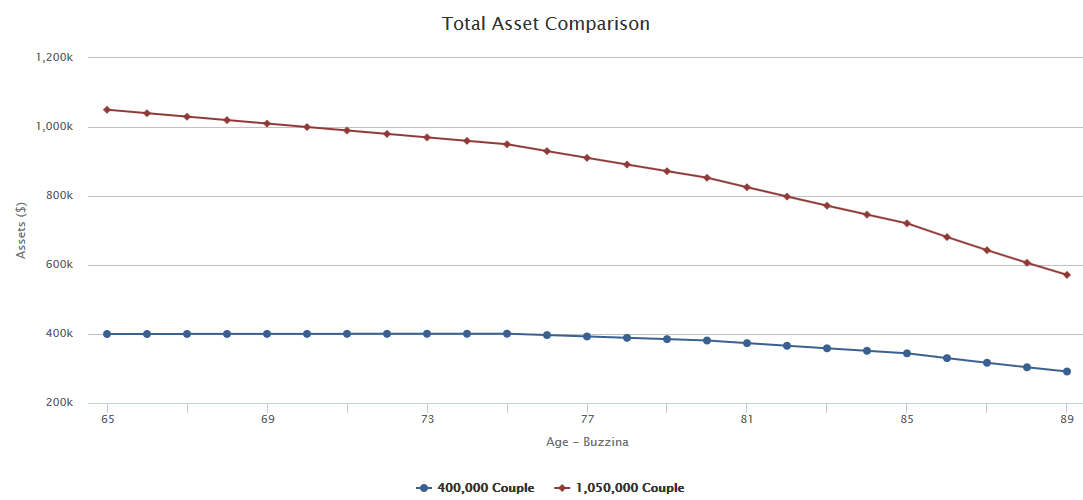

The below table sets out the results.

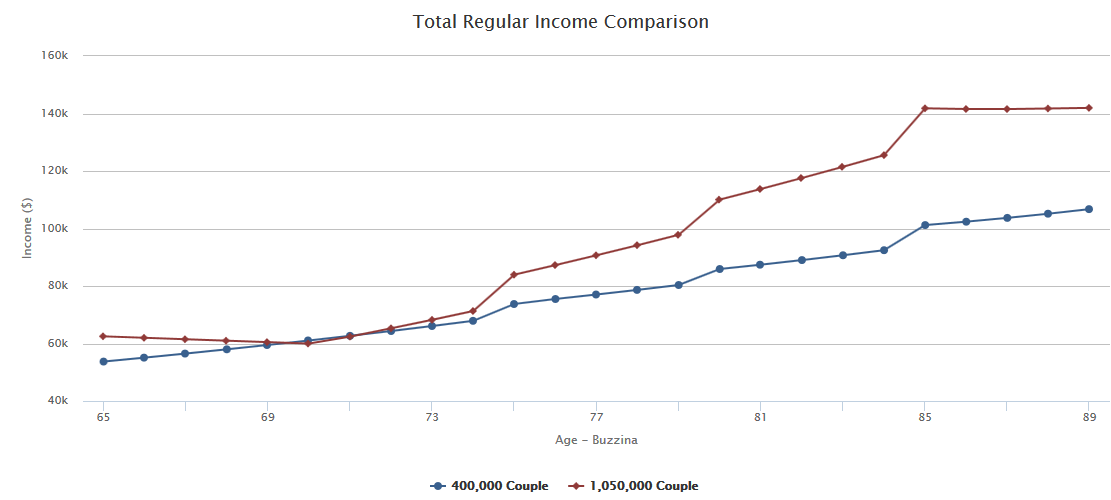

In the above example, the person with $1,050,000 has a significantly higher regular income over time due to the higher amount of capital available to them and the requirement to draw down an increased minimum amount from their pension accounts as they get older.

The above graph also shows that even with the increased withdrawals, in this particular scenario you will still have considerably more assets throughout your life that you can also draw down on if you need to. Not only that but you need to remember that even if you do not qualify for any age pension at the start of your retirement, as your assets decrease over time you may end up qualifying for the age pension later on in retirement.

In fairness to the author of the original article, it was probably designed to indicate that in order to have a ‘comfortable’ retirement, due to the age pension, you can get by on a smaller pension savings balance. To suggest however that “retirees with modest savings can be better off than those with more than twice as much” is just plain wrong and doesn’t take into account all the pieces of the puzzle.

To speak to someone about growing your retirement wealth so you can have a better lifestyle in retirement speak to one of our advisers at JBS Financial Strategists.

– Liam Rutty –