Gardening | Amy

I started gardening four years ago as a way of relaxing. What started as one small garden bed in the backyard quickly turned into me redesigning the entire front yard! My favourite time of year has to be end of winter through to spring. That is when all the bulbs that are hidden in the various garden beds come to life again and dazzle us with their colour.

I started gardening four years ago as a way of relaxing. What started as one small garden bed in the backyard quickly turned into me redesigning the entire front yard! My favourite time of year has to be end of winter through to spring. That is when all the bulbs that are hidden in the various garden beds come to life again and dazzle us with their colour.

In order to prepare for our spring garden we need to start planning now in January. I have learned that with gardening, I am always focussed at least 6 months ahead. Spring bulbs need to be planted in February/March, the exception being Tulips. Tulips need to be placed  in the fridge for five weeks and then can be planted in May. It sounds odd, putting bulbs into the fridge before planting, but they need to be chilled in order to flower.

in the fridge for five weeks and then can be planted in May. It sounds odd, putting bulbs into the fridge before planting, but they need to be chilled in order to flower.

This year we will be shuffling bulbs around, what I refer to as my ‘Bluebell garden’ will be dug up and halved to make room for more Tulips. The Ranunculus and Anemone gardens will be added to as well. The hardest part is limiting myself each year with how many bulbs to purchase! It is very easy to get carried away with ideas about what I want to add, I have to remember that it is very important to look after what is already there, the bulbs need fertilising and fresh compost every year. The same principle can be applied to retirement savings, it is important to look after what is there; because once it is gone it is costly to start again.

It is always sad when the spring flowers start to fade and the garden looks lifeless once again. But, then I remember that summertime means David Austin Roses will bloom, colour will be restored and the next project begins: planting sunflower seeds!

balance of small inactive account directly to the ATO. This is still your super and you are able to claim and transfer it to your preferred super fund at any time.

balance of small inactive account directly to the ATO. This is still your super and you are able to claim and transfer it to your preferred super fund at any time.

udi to put the new 2016 RS3 through its paces. The R salesman Andrew was extremely friendly and allowed me to take an extensive test drive – with him as a passenger – clearly I looked like too much of a hoon for him to let me go by myself. He diligently explained all of the amazing features of the car and was keen to find out about the type of driving I normally do so that he could adapt his pitch to suit my needs.

udi to put the new 2016 RS3 through its paces. The R salesman Andrew was extremely friendly and allowed me to take an extensive test drive – with him as a passenger – clearly I looked like too much of a hoon for him to let me go by myself. He diligently explained all of the amazing features of the car and was keen to find out about the type of driving I normally do so that he could adapt his pitch to suit my needs. you to sign a waiver on the phone. Everything that was discussed, including the signed waiver is automatically emailed to you, genius.

you to sign a waiver on the phone. Everything that was discussed, including the signed waiver is automatically emailed to you, genius.

on impulsive or unnecessary items

on impulsive or unnecessary items

insurance one we prefer to avoid however is necessary. Most Aussie families would find it difficult and almost impossible to meet daily living expenses should the main income earner pass away. This often leads to families having to move back in with relatives, increasing debt levels and even losing the family home.

insurance one we prefer to avoid however is necessary. Most Aussie families would find it difficult and almost impossible to meet daily living expenses should the main income earner pass away. This often leads to families having to move back in with relatives, increasing debt levels and even losing the family home.

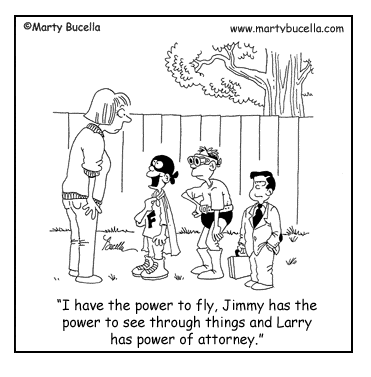

Enduring powers of attorney (medical treatment) are not impacted by the changes and will continue to be regulated separately under the Medical Treatment Act. The new law does not invalidate existing powers of attorney.

Enduring powers of attorney (medical treatment) are not impacted by the changes and will continue to be regulated separately under the Medical Treatment Act. The new law does not invalidate existing powers of attorney.