Stepped vs Level Premiums

Personal insurance policies may have a large effect on our cash flow. One factor which dictates how much you pay is whether your insurance premiums are structured on a stepped or level premium. If you’ve ever held any form of personal insurance then you may have come across these terms, however have you ever wondered what the differences is between the two? When your personal insurance policy is initially set up, you have the option to choose whether to have the premiums set on a stepped or level structure.

Having your premiums on a stepped structure would generally mean you pay lower premiums initially compared to a level structure. Stepped premiums increase annually with the added risk of a potential claim. The downside however is that over time your stepped premiums will increase each year as you get older. This method may not be desirable to some as the premiums may become too expensive to sustain over time. In certain circumstance, stepped premiums are more favourable.

For example a 25 year old male may not be able to afford insurance premiums on a level structure, however in several years’ time he may be earning a larger income and thus be able to afford level premiums. So in the meantime he can put in place his personal insurance policy on stepped premiums to ensure he’s covered and once can he can afford to pay level premiums, he can change the premium structure.

Or you may have to take out an additional loan for a short period of time (say 5 years) and you can then ensure you have sufficient insurance to cover this debt for just the 5 years and cancel the policy once the debt is repaid.

A level premium is the second option you have and it calculates the risk over the life of the policy (assuming it is held to the expiry of the policy – age 65 and above depending on your policy) and spreads the cost of this risk. Although initially more expensive to set up, insurance policies on a level structure will not increase over time (excluding any CPI increase). A disadvantage to having level premiums is it may have a larger impact on your cash flow initially, however over time the savings will catch up.

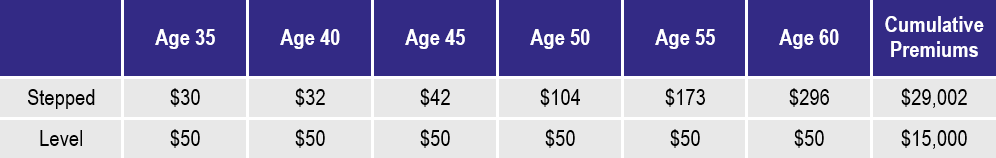

The following table is an example of a 35 year old male with $500,000 of death insurance.

*Please note premiums are shown in months. The above table is only an example, for personalised quotes please contact your adviser.

As shown above, stepped premiums are initially cheaper, however over time becomes much more expensive. In the above example the insured person from age 35 to 60, will have paid $14,002 more under stepped premiums compare to a level structure.

Stepped and Level premiums are only one factor to consider when reviewing your insurance needs tailored to your needs. So if you’re interested to know more, please contact JBS for further details and advice.

Savory Lollies – Waldorf Rocket, Salmon Twister and Chicken Feast

Savory Lollies – Waldorf Rocket, Salmon Twister and Chicken Feast

They had many different and awesomely built displays, there was even a huge Lego replica of the Golden Gate bridge, which I had only just seen the real thing for the first time a few months before hand. It was out of this world, if only I had a big enough room in my house to dedicate it to building Lego. My girlfriend can also be a big kid, so she jumped at the chance of having a photo with the Lego Tigger!

They had many different and awesomely built displays, there was even a huge Lego replica of the Golden Gate bridge, which I had only just seen the real thing for the first time a few months before hand. It was out of this world, if only I had a big enough room in my house to dedicate it to building Lego. My girlfriend can also be a big kid, so she jumped at the chance of having a photo with the Lego Tigger!

eing out in the middle of the paddock when it was raining and I was driving. Without warning Dad reached over and spun the steering wheel. We spun around a number of times in the mud and it really reinforced just how quickly and easily you can lose control. I still remember the feeling of being out of control in the Moke and this lesson has no doubt held me in good stead throughout my adult life, to the point where I’m yet to have a car accident (touch wood).

eing out in the middle of the paddock when it was raining and I was driving. Without warning Dad reached over and spun the steering wheel. We spun around a number of times in the mud and it really reinforced just how quickly and easily you can lose control. I still remember the feeling of being out of control in the Moke and this lesson has no doubt held me in good stead throughout my adult life, to the point where I’m yet to have a car accident (touch wood). There is no doubt however that Dad’s most successfully idea has definitely been our olive trees. In 2000 Mum and Dad planted over 50 trees in our front paddock.

There is no doubt however that Dad’s most successfully idea has definitely been our olive trees. In 2000 Mum and Dad planted over 50 trees in our front paddock.  For the past 7 or so years the crop has been increasing to the point that a big SOS goes out each year around mother’s days for pickers to come back to Cosgrove South for a “farm experience”. This is become a great tradition, one that my children Riley & Lucy look forward to each year. Last year was our biggest crop, over 440kg’s of olives, which equated to 110 litres of oil. Dad takes it to an Italian man on the other side of Shepparton who uses a traditional olive press to make traditional olive oil. Although the quality is well and truly good enough, Mum and Dad don’t produce the oil for commercial purpose. They get more pleasure out of gifting it to their family and friends, and those who have been fortunate enough to taste it (including the JBS team) continue to ask when the next crop is due.

For the past 7 or so years the crop has been increasing to the point that a big SOS goes out each year around mother’s days for pickers to come back to Cosgrove South for a “farm experience”. This is become a great tradition, one that my children Riley & Lucy look forward to each year. Last year was our biggest crop, over 440kg’s of olives, which equated to 110 litres of oil. Dad takes it to an Italian man on the other side of Shepparton who uses a traditional olive press to make traditional olive oil. Although the quality is well and truly good enough, Mum and Dad don’t produce the oil for commercial purpose. They get more pleasure out of gifting it to their family and friends, and those who have been fortunate enough to taste it (including the JBS team) continue to ask when the next crop is due.

Christmas I always go home to see my family & friends back home in Queensland. When I arrived in the “sunny state” on Christmas day the weather was not so sunny and the outlook was not looking great for the next couple of weeks. Trying to keep active/outdoor kids amused inside for five days was becoming difficult, my niece & nephew aren’t really fans watching cricket on TV (this was also depressing as the weather in Victoria was amazing) so the decision was made to head back to Victoria early to actually have a summer break.

Christmas I always go home to see my family & friends back home in Queensland. When I arrived in the “sunny state” on Christmas day the weather was not so sunny and the outlook was not looking great for the next couple of weeks. Trying to keep active/outdoor kids amused inside for five days was becoming difficult, my niece & nephew aren’t really fans watching cricket on TV (this was also depressing as the weather in Victoria was amazing) so the decision was made to head back to Victoria early to actually have a summer break.