Turning 55 might not be the same again…

Are you turning 55 soon? Well congratulations! They say life starts at 55….or was that  40?? Either way, you get to have a party, and get lots of presents. But one present that you won’t be able to get is your superannuation.

40?? Either way, you get to have a party, and get lots of presents. But one present that you won’t be able to get is your superannuation.

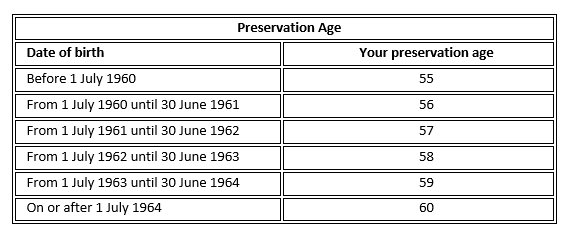

For Australians to be able to access their superannuation, they must have met a condition of release. Generally speaking, a condition of release is usually around retirement or long term illness or injury. Part of the retirement condition of release is a requirement to have reached ‘Preservation Age’ which is set by the Government and is based on your birthday.

From 1 July 2015, Australians turning 55 will no longer be able to access their superannuation if retired, but rather will have to wait another 12 months to be able to do so. The preservation age will progressively increase in the coming years and you should be aware of them to know when your preservation age is.

What does this mean for you? Well, if you were planning on retiring early, you need to ensure that you have access to alternative funds or assets to provide an income to cover your expenses before you are legally allowed to access your superannuation funds. While retiring early may not be everyone’s plan, you should also take this into consideration as the preservation age is only increasing and you may find that when you get closer to retirement, you might want to look at your options and if you don’t have sufficient alternative options, you may have to continue to work until you can access your superannuation.

This shouldn’t be confused with the Age Pension age which is the age that you are entitled to receive Government benefits if you meet other qualifying conditions. The Financial Services Council has called for further increase to the preservation age to bring it in line with Age Pension age, as they are worried that some Australians will choose to retire early and utilise their superannuation for the years before Age Pension kicks in, and then rely on the Government to fund the remainder of your life.

If you’re worried about what the increasing preservation age will mean to your retirement, you should contact JBS for a chat.

may even prompt you to make changes where needed.

may even prompt you to make changes where needed.

Savory Lollies – Waldorf Rocket, Salmon Twister and Chicken Feast

Savory Lollies – Waldorf Rocket, Salmon Twister and Chicken Feast

They had many different and awesomely built displays, there was even a huge Lego replica of the Golden Gate bridge, which I had only just seen the real thing for the first time a few months before hand. It was out of this world, if only I had a big enough room in my house to dedicate it to building Lego. My girlfriend can also be a big kid, so she jumped at the chance of having a photo with the Lego Tigger!

They had many different and awesomely built displays, there was even a huge Lego replica of the Golden Gate bridge, which I had only just seen the real thing for the first time a few months before hand. It was out of this world, if only I had a big enough room in my house to dedicate it to building Lego. My girlfriend can also be a big kid, so she jumped at the chance of having a photo with the Lego Tigger!