Superannuation

The end of the financial year always seems to creep up on us. Understanding what you could do before and after 30 June can provide the icing on the cake for employees, investors and those in small business. When it comes to superannuation, make sure you maximise the tax deduction this year or salary sacrifice the right amount so you get the best possible outcome and don’t end up with tax penalties.

Concessional contributions are most commonly contributions from your employer, however if you receive a bonus or have additional cash flow and your marginal tax rate is more than 15%, salary sacrifice into superannuation can be a strategy to boost your super balance and decrease your tax. To receive the tax benefit in 2016 your fund must receive the contribution prior to 30 June 2016.

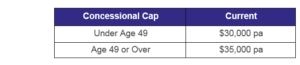

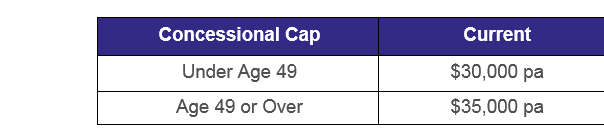

The current concessional contributions are:

It is important that you don’t go over your limit.

Claiming a tax deduction for personal superannuation contributions

If you are self-employed, (you earn less than 10% of your income from wages from an employer, fringe benefits and other related payments) you may qualify for a personal tax deduction to superannuation.

If you intend to claim a tax deduction make sure you are eligible to claim a tax deduction – you may want to speak to JBS first to make sure. You need to notify the fund of the amount you wish to claim as a deduction as soon as possible to ensure you have the relevant acknowledgement form from your super fund before you lodge your tax return.

Salary sacrificed contributions

Foregoing part of your salary in favour of having additional concessional contributions made to super by an employer may deliver tax advantages.

Existing salary sacrifice arrangements should be reviewed on a regular basis, at least annually. Reviewing a salary sacrifice arrangement before the end of the financial year and amending for the following financial year represents good planning and ensures that you do not exceed any caps resulting in additional tax.

Government co-contributions for low income earners

If you earn less than $50,454 a year and make a non-concessional contribution* to superannuation you may be eligible to receive a Government contribution of up to an additional $500. The actual amount, and eligibility for the co-contribution, depends on a number of factors including the proportion of total income derived from employment, taxable income (and lodging a tax return), age and level of contributions.

*Making large non-concessional contributions is a big decision and advice from a financial planner is recommended before any contribution is made. In the recent Budget, a lifetime limit of $500,000 was placed on non-concessional contributions and therefore it is even more important that you seek assistance before making any after-tax contribution to super.

Low Income superannuation contribution

The Government will provide a superannuation contribution of up to $500 equal to 15% of concessional contributions made into superannuation to eliminate tax payable on these funds when deposited into super. If you are earning $37,000 or less and your employer pays superannuation contributions to a complying superannuation fund you may be eligible for this contribution. You do not need to do anything to claim this payment, but rather the ATO will determine your level of contribution and make it directly to your super account once tax returns have been lodged.

Spouse contributions

If your spouse has an income of less than $10,800, you may be entitled to receive a tax offset of up to $540, if you make a non-concessional contribution to their super account. The tax offset reduces if your spouse’s income is between $10,800 and $13,800, when it cuts out. The maximum offset available is 18% of the contribution made, subject to a maximum offset of $540.

Personal and Investment

Claim all work related deductions

The task of compiling all work related deductions can seem all too hard. However, taking the time to understand what work related expenses are potentially deductible can save you considerable cost. Where you do not have the necessary receipts on hand you can still claim up to $300 of work-related expenses provided the claims relate to outgoings you necessarily incurred in your job or business.

Maximise motor vehicle deductions

If you use your car for work-related travel and your kilometres for the year do not exceed 5,000 kms, you can claim a deduction for your car expenses on a cents per kilometre basis. The allowable rate for such claims changes annually. Any such work-related travel claims must be based on reasonable estimates.

If you use your car for significant amounts of work-related travel you may be able to claim a deduction for your total running expenses to the extent you have used it for work. However, such claims are only available where you have the required log book, odometer readings and receipts.

Property deductions

If you have an investment property and some repairs are required, bring forward the works before 30 June. It is important the invoice is paid pre 30 June to be deductible in this financial year.

Improve your tax situation

There are many things to consider when it comes to your taxes. Here, we’ll give you just a few options to consider to improve your tax situation and explain the importance of your getting your taxation documents in order.

Defer or bring forward income for the current financial year

Consider deferring taxable income, until the start of the next financial year. For example, you may want to consider postponing the sale of assets which may incur capital gains tax. However, in some cases it might be advisable to bring forward income to the current financial year, particularly if your projected income in the next financial year is expected to result in you moving into a higher marginal tax bracket.

Pre-pay interest and tax deductible expenses

Pre-paying interest and tax deductible expense may allow the tax deduction to be claimed in the current financial year.

Tax documentation

It’s important that you keep all your tax documents in order. Review receipts, log books and other documentation to ensure that all records required to manage tax affairs are in order. This will help make the end of the financial year process run as smooth as possible.

Review Your Pension Drawings

If you’re drawing an income from an account based pension, also known as an allocated pension, check to ensure that the prescribed minimum level of income has been drawn in the current financial year. Failure to draw the correct minimum level of income may result in unfavourable tax consequences.

Ensure your SMSF is firmly on track

Managing your own superannuation fund gives you the greatest flexibility over exactly how and where your super investments are made. However, it also means that you are solely responsible for complying with super and tax laws. With the end of the financial year looming, now is as good a time as any to make sure your SMSF is on track.

Investment strategy

Each SMSF must have an investment strategy that reflects the high level investment strategy adopted by the trustees of the fund. As part of the investment strategy, trustees are also required to consider insurance for each member of the fund. In addition to formulating and implementing an investment strategy, trustees are also required to regularly review the fund’s investment strategy.

As we approach the end of another financial year, this presents a good opportunity for trustees to review their investment strategy and ensure that it continues to be appropriate for the fund, particularly where members’ circumstances may have changed.

Value assets

It’s a requirement that trustees of a SMSF value their fund’s assets at market value. This does not necessarily involve trustees obtaining formal valuations from a qualified valuer, however valuations must be provided by a person familiar with valuing such assets.

The JBS team are here to help, if you have any questions leading up to the end of financial year please contact us.

TIP 1: Set Financial Goals

TIP 1: Set Financial Goals

I started gardening four years ago as a way of relaxing. What started as one small garden bed in the backyard quickly turned into me redesigning the entire front yard! My favourite time of year has to be end of winter through to spring. That is when all the bulbs that are hidden in the various garden beds come to life again and dazzle us with their colour.

I started gardening four years ago as a way of relaxing. What started as one small garden bed in the backyard quickly turned into me redesigning the entire front yard! My favourite time of year has to be end of winter through to spring. That is when all the bulbs that are hidden in the various garden beds come to life again and dazzle us with their colour. in the fridge for five weeks and then can be planted in May. It sounds odd, putting bulbs into the fridge before planting, but they need to be chilled in order to flower.

in the fridge for five weeks and then can be planted in May. It sounds odd, putting bulbs into the fridge before planting, but they need to be chilled in order to flower.

balance of small inactive account directly to the ATO. This is still your super and you are able to claim and transfer it to your preferred super fund at any time.

balance of small inactive account directly to the ATO. This is still your super and you are able to claim and transfer it to your preferred super fund at any time.

ave to wait at least a month as well.

ave to wait at least a month as well.

ear, non-concessional contributions are limited to a maximum of $180,000. If aged 64 or under on 1 July 2014, you’re able to bring forward up to three years’ worth of contributions (up to $540,000) provided you haven’t done this previously.

ear, non-concessional contributions are limited to a maximum of $180,000. If aged 64 or under on 1 July 2014, you’re able to bring forward up to three years’ worth of contributions (up to $540,000) provided you haven’t done this previously.