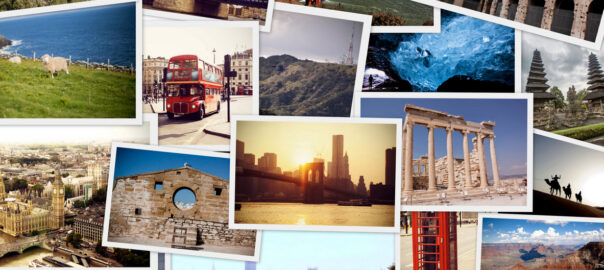

A postcard from your retirement: Planning for your future.

Retirement is a destination we all aim for, but the journey looks different for everyone. How do you ensure you save enough to create the retirement you desire?

Retirement is a destination we all aim for, but the journey looks different for everyone. How do you ensure you save enough to create the retirement you desire?

It’s not just about deciding when you’ll retire; it’s about envisioning what you’ll do when you transition from full-time work. For many, retirement might mean tending to the garden, spending time with grandchildren, pursuing hobbies like golf or art, or embarking on adventures around the globe. Whatever your vision, your future self in retirement wants you to know, it’s essential to prioritise your financial plans to make it a reality.

“At JBS Financial, we often discuss the concept of ‘knowing your financial freedom number.’ This involves identifying what you want to achieve in retirement. Whether it’s checking off items on your bucket list or ensuring financial security, understanding your goals is the first step towards crafting a personalised retirement plan.” – Jenny Brown, CEO and Founder.

Once you’ve defined your retirement dreams, it’s time to align your finances accordingly. This means determining how much money you’ll need to cover both everyday expenses and leisure activities. Contrary to popular belief, many retirees find that their financial needs remain significant in the early years of retirement, especially if they have ambitious travel plans or costly hobbies.

To ensure your retirement funds last as long as you need them to, it’s crucial to separate your income requirements into different categories: living expenses and discretionary spending. This distinction allows for better financial planning and ensures you can enjoy your retirement without worrying about running out of money.

With your goals in mind, the next step is to work with a financial adviser to develop a strategy for achieving them. This involves calculating how much you need to save each month to reach your financial freedom number and determining the appropriate investment approach based on your risk tolerance and time horizon.

Whether you choose to invest inside or outside of superannuation or a combination of both, the key is to have a comprehensive plan that covers all aspects of your financial future. Regular check-ins with your adviser will help ensure you stay on track to meet your goals and adjust your plan as needed.

Remember, retirement is not the end of your financial journey but the beginning of a new chapter. By starting your retirement planning today and crafting a plan that works for you, you can look forward to living the life you’ve always dreamed of in your golden years.

So, as you envision your postcard-perfect retirement, ask yourself:

Do you have the right plan in place?

Is it tailored to your needs and aspirations?

If not, there’s no better time than now to take the first step towards securing your financial future. Reach out to discuss what your retirement postcard will look like and how we can help you get there.