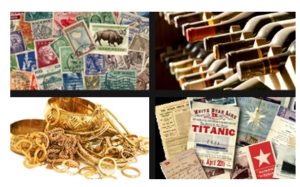

SMSF Collectible Assets

1 July 2016 is the date that new rules around holding collectibles in an SMSF come into effect and it has been noted that SMSF trustees should not expect a transition or leniency period. The legislation changes have been in discussion in some form or another for around five years, giving trustees plenty of time to make the relevant changes to their Fund assets.

The new rules relatin g to collectibles and personal use assets, such as artwork, jewellery, vehicles, boats and wine, restrict the storage of these items as well as placing additional requirements on protecting these assets. From July, collectibles cannot be stored in a private residence of a member or a related party. You can continue to store your collectibles in a premises owned by a related party as long as it’s not their private residence and is strictly forbidden to be displayed. You must also keep documented records on the reasoning behind your storage decision.

g to collectibles and personal use assets, such as artwork, jewellery, vehicles, boats and wine, restrict the storage of these items as well as placing additional requirements on protecting these assets. From July, collectibles cannot be stored in a private residence of a member or a related party. You can continue to store your collectibles in a premises owned by a related party as long as it’s not their private residence and is strictly forbidden to be displayed. You must also keep documented records on the reasoning behind your storage decision.

While we are on related parties, you can only lease collectibles to an unrelated party and the lease must be on arm’s length terms. And should you be selling the asset to a related party, it must be at market rates and have a professional valuation to confirm market price. To be considered a qualified, independent valuer, they must either hold a formal valuation qualification or be considered to have specific experience or knowledge by their professional community.

All collectibles must also be insured in the name of the Fund within seven (7) days of purchase. Insurance must be maintained on the asset at all times while held by the Fund and cannot form part of another policy; such as a trustees personal home and contents insurance.

If your collectible assets within your SMSF cannot tick off the above, you may wish to consider selling the asset prior to the 1 July 2016 date to ensure that your fund remains compliant. It seems that many trustees have been employing this strategy as collectible assets made up $713 million (0.18%) of all SMSF in June 2011, which is a significant amount more than reported in June 2015, with only $389 million (0.07%) of the massive $590 billion assets held by SMSFs. Many believe the reduction is due to the discussions and subsequent implementation of new legislation resulting from the Cooper Review completed in 2010.

If you have collectibles or personal use assets within your SMSF and are concerned about complying with the new legislation, get in contact with the team at JBS prior to the July 2016 deadline to ensure you take appropriate steps to keep your SMSF compliant.