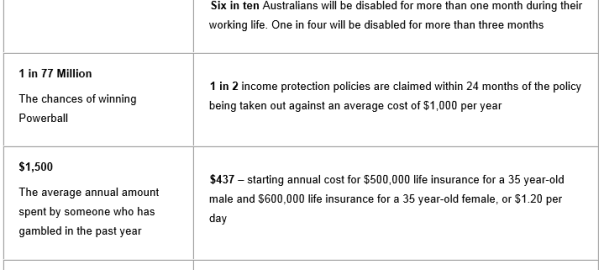

Australians love being able to enjoy life with their friends and family, travel the world and drink till the sun comes up. In order to do so we earn, save, invest, borrow and do whatever is necessary to accumulate enough funds to enjoy the finer things in life. For a lot of Australians, taking financial risks is simply a part of everyday life; trading stocks, gambling or buying investment properties.

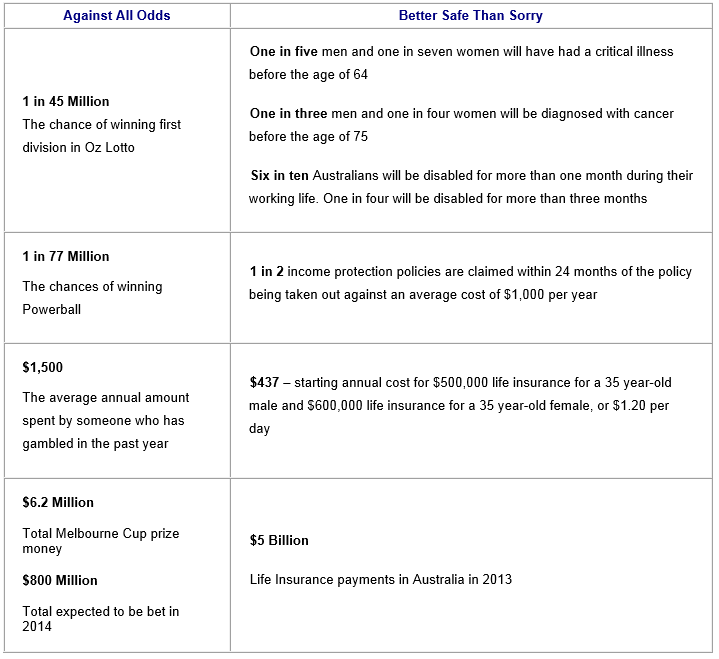

Today, over 80% of Australians are taking the biggest financial risk and not protecting their biggest asset, which is their own ability to earn money. It’s relatively easy to earn it, it’s easier to burn it and apparently 80% of us think it’s too hard to protect.

In 2012, the Australian Life Insurance Industry paid out $4.4 billion in total claims. This stat isn’t meant to highlight the fact that insurers do payout, but highlights the fact that tens of thousands of Australians in 2012 died, suffered from a terminal illness, were diagnosed with a critical illness or suffered a serious injury or illness stopping them from earning their most valued asset, income.

There are several Personal Insurance types that can assist in protecting you financially such as Life, Total & Permanent Disablement (TPD), Trauma and Income Protection. Each serves its own purpose; to provide financial aid in the event the proverbial dung hits the fan. Yet 80% of us think…

• “It’ll never happen to me”, $4.4 Billion says otherwise.

• “I’m sure it’s in my Super”, maybe, but is it enough?

• “It’s too expensive”, where else can you get $4.4 billion?

Although Super is a convenient funding mechanism for Personal insurance it doesn’t come without its difficulties, especially at claim time.

When you hold Insurance within a su per fund, the super trustee effectively owns your insurance and it is their responsibility to ensure any insurance payment made into the fund meets a ‘condition of release’ before they can be withdrawn from your super fund. These conditions are set by the Superannuation Industry (Supervision) Act 1993 (SIS Act) and includes insurance claim benefits.

per fund, the super trustee effectively owns your insurance and it is their responsibility to ensure any insurance payment made into the fund meets a ‘condition of release’ before they can be withdrawn from your super fund. These conditions are set by the Superannuation Industry (Supervision) Act 1993 (SIS Act) and includes insurance claim benefits.

In the event an insurer pays out a claim, the benefits (money) are paid to the super trustee, not you or your beneficiaries. It is then up to the trustee to determine if you meet a ‘condition of release’ before paying you the funds. So a few legislative changes have been introduced, effective 1 Just 2014 to align and hopefully resolve the double handling of claims.

The old way:

Pre 1 July 2014, if you implemented Insurance inside a super fund, in order to get the proceeds of a successful insurance claim in your hands, you were required to satisfy two separate conditions, as mentioned above:

1. The definitions under the insurance policy set by the insurance company to pay out the claim; and

2. The superannuation ‘condition of release’ rules set by the SIS Act.

Unfortunately for some people who successfully claimed on their insurance, this made the process difficult. Just because the insurance company said, “yes you can make a claim”, didn’t necessarily mean your super fund would hand over the cash.

The simple fact of the matter was a misalignment if conditions existed. Insurers were approving claims, paying the benefits to the super trustee, but the super trustee was holding the funds inside the members super account because a ‘conditions of release’ was not met.

The new way

From 1st July 2014, the aforementioned conditions must now mirror one another, meaning that definitions of insurance policies available under super are much stricter. They must reflect the ‘condition of release’ rules governed by the SIS Act. This however, does not come without its pitfalls:

You can no longer implement the following types of insurances inside super:

* Trauma cover

* Agreed value Income Protection

* Own Occupation TPD

Because of these restrictions, you may have to fund portions or entire personal insurance policies from your own pocket.

On the upside this new ruling will reduce a lot of stress at claim time as it sets expectations and makes the process more black and white, rather than rainbow coloured. The new legislation changes also respect insurances implemented prior to 1 July 2014, you just have to be aware that your super trustee may stop or reduce the claim payable to you, holding any ineligible funds that don’t meet a condition of release inside your super.

We think the legislative changes are a positive move as the point of personal insurance is to protect you and your family financially, in the event of a medical tragedy such as death, or major injury / illness. Any simplifications made to the claims process is always welcomed as it reduces stress and minimises time wasted during an already stressful time for both the claimant and their loved ones.

If you want to know more or if you want a review of your insurances whether you’re a JBS client or not, give us a call and we can chat further.

Christmas I always go home to see my family & friends back home in Queensland. When I arrived in the “sunny state” on Christmas day the weather was not so sunny and the outlook was not looking great for the next couple of weeks. Trying to keep active/outdoor kids amused inside for five days was becoming difficult, my niece & nephew aren’t really fans watching cricket on TV (this was also depressing as the weather in Victoria was amazing) so the decision was made to head back to Victoria early to actually have a summer break.

Christmas I always go home to see my family & friends back home in Queensland. When I arrived in the “sunny state” on Christmas day the weather was not so sunny and the outlook was not looking great for the next couple of weeks. Trying to keep active/outdoor kids amused inside for five days was becoming difficult, my niece & nephew aren’t really fans watching cricket on TV (this was also depressing as the weather in Victoria was amazing) so the decision was made to head back to Victoria early to actually have a summer break.

At JBS it’s not all work and no play, we love to kick back and have FUN too. The team also loves a bit of healthy competition between one another, so it was decided that a game of soccer was a great way to de-stress after work.

At JBS it’s not all work and no play, we love to kick back and have FUN too. The team also loves a bit of healthy competition between one another, so it was decided that a game of soccer was a great way to de-stress after work.

Never before have I had a better reason to bail work the second the clock hits 5.30pm than now, for what awaits me when I walk into the front door each night I arrive home. On Tuesday, 14th October @ 6.22pm, the latest miracle to enter this world had arrived. I became the father to little Ashton.

Never before have I had a better reason to bail work the second the clock hits 5.30pm than now, for what awaits me when I walk into the front door each night I arrive home. On Tuesday, 14th October @ 6.22pm, the latest miracle to enter this world had arrived. I became the father to little Ashton. eyes could see.

eyes could see.

Everyone needs a hobby and mine is a tiny little Italian. I have a 1960 Fiat 500 that I am very slowly restoring (or destroying if you talk to those in the Fiat club as I’m not really going original). I love cars and I love working on them. I’m not sure I’m actually any good or know anything that I’m doing at all but I play around, take nuts and bolts off and hope they all go back on.

Everyone needs a hobby and mine is a tiny little Italian. I have a 1960 Fiat 500 that I am very slowly restoring (or destroying if you talk to those in the Fiat club as I’m not really going original). I love cars and I love working on them. I’m not sure I’m actually any good or know anything that I’m doing at all but I play around, take nuts and bolts off and hope they all go back on.

I want to do as much as possible on the car myself. I’ve even sewn my own seat covers from leather and I stripped the car when I originally got it. The last thing I did on the car was get the seam seal out and cover all the welds. I’ve unfortunately found a broken bolt that’s welded to the car, so more welding, more parts, and more money.

I want to do as much as possible on the car myself. I’ve even sewn my own seat covers from leather and I stripped the car when I originally got it. The last thing I did on the car was get the seam seal out and cover all the welds. I’ve unfortunately found a broken bolt that’s welded to the car, so more welding, more parts, and more money. conversion. I have the newer engine (650cc instead of the 500cc, so I might hit 100 kms on a downward slope with the wind) but I need to somehow work out how to connect it to the old gearbox. It seems that it’s not as easy as the 2 page instruction sheet I downloaded off the net. So if anyone knows how I do this, I’d love the help because I really need it!

conversion. I have the newer engine (650cc instead of the 500cc, so I might hit 100 kms on a downward slope with the wind) but I need to somehow work out how to connect it to the old gearbox. It seems that it’s not as easy as the 2 page instruction sheet I downloaded off the net. So if anyone knows how I do this, I’d love the help because I really need it!

This is set to change on 1st January 2015 when new ‘deeming’ rules come into effect for account based pensions meaning they will be subject to the same ‘deeming’ rules that apply to financial investments. All new account based pensions will be deemed as earning a certain rate of income regardless of the actual return of the investment. The current deeming rates are as follows:

This is set to change on 1st January 2015 when new ‘deeming’ rules come into effect for account based pensions meaning they will be subject to the same ‘deeming’ rules that apply to financial investments. All new account based pensions will be deemed as earning a certain rate of income regardless of the actual return of the investment. The current deeming rates are as follows:

per fund, the super trustee effectively owns your insurance and it is their responsibility to ensure any insurance payment made into the fund meets a ‘condition of release’ before they can be withdrawn from your super fund. These conditions are set by the Superannuation Industry (Supervision) Act 1993 (SIS Act) and includes insurance claim benefits.

per fund, the super trustee effectively owns your insurance and it is their responsibility to ensure any insurance payment made into the fund meets a ‘condition of release’ before they can be withdrawn from your super fund. These conditions are set by the Superannuation Industry (Supervision) Act 1993 (SIS Act) and includes insurance claim benefits.