5 things you need to do to ensure you are ready for retirement

Some of us dream about the day we can finally retire and do all the things we never had time for. The opportunity to travel to Africa, the sea change, or that food safari in Japan. Others feel they’re too busy to think about retirement or fearful they won’t have enough to retire comfortably so they put off thinking about it.

Yet we all know the sooner you start planning, the better your chances of making the most of your retirement years. The fact is, many of us could spend almost as long in retirement as we did in the workforce.

An independent industry research reveals only 44% of Australians over the age of 40 feel prepared for retirement, down from 49% in 2015. More alarmingly, 51% of those already retired expect to outlive their retirement savings, up significantly from 33% in 2013.

In this article, you’ll learn about:

- The biggest issues that can impact your retirement;

- The steps you need to do to plan for the retirement lifestyle you want; and

- How you can close the gap between your retirement dream and your projected savings

Issues that can impact your retirement

Some people enter retirement financially secure but that security disappears over the years. Here are 5 common reasons that cause retirement plans to go off track.

Not understanding your time horizon. This is the length of time you need to hold an investment before you sell and get your money back. Generally, the longer the time between today and retirement, the higher the level of risk your portfolio can withstand.

No spending plans. If you don’t have a rough idea of what your ideal retirement lifestyle will cost, you’ll find it hard to work out how much you would need to save to fund it.

Unrealistic expectation of returns. How much risk can you tolerate to meet your objectives? You’ll need to be comfortable with the risks being taken in your portfolio to achieve the projected returns. For example, when the market declines, buy more – don’t sell. Refuse to give in to panic.

Not calculating how much you’ve got now. How close are you to your goal? If you have debts that need to be paid, will you have enough money saved to live on for at least 20 years after retirement?

Not tracking your progress. While future market performance, interest rates, and government policy are impossible to predict, do you know how much extra contributions you need to make to meet your goal? Is there a gap between your retirement dream and your retirement savings?

As you can see, it’s not always the investment market declines that are the cause. It’s a lack of planning.

Here are 5 simple steps to help you get the ball rolling to plan for a successful retirement.

Step 1: Design your dream retirement

Planning for retirement starts with thinking about your retirement goals and how long you have to meet them. You need to plan for how you want to live and what you want to do. Do you want to go overseas each year? Do you want to buy a caravan and tour around Australia? Do you want to be able to eat out regularly or buy a new car every 2 years? Perhaps you want to help the kids financially.

If you are part of a couple, share your thoughts and expectations. Make any changes now while you can.

Step 2: Determine your spending needs

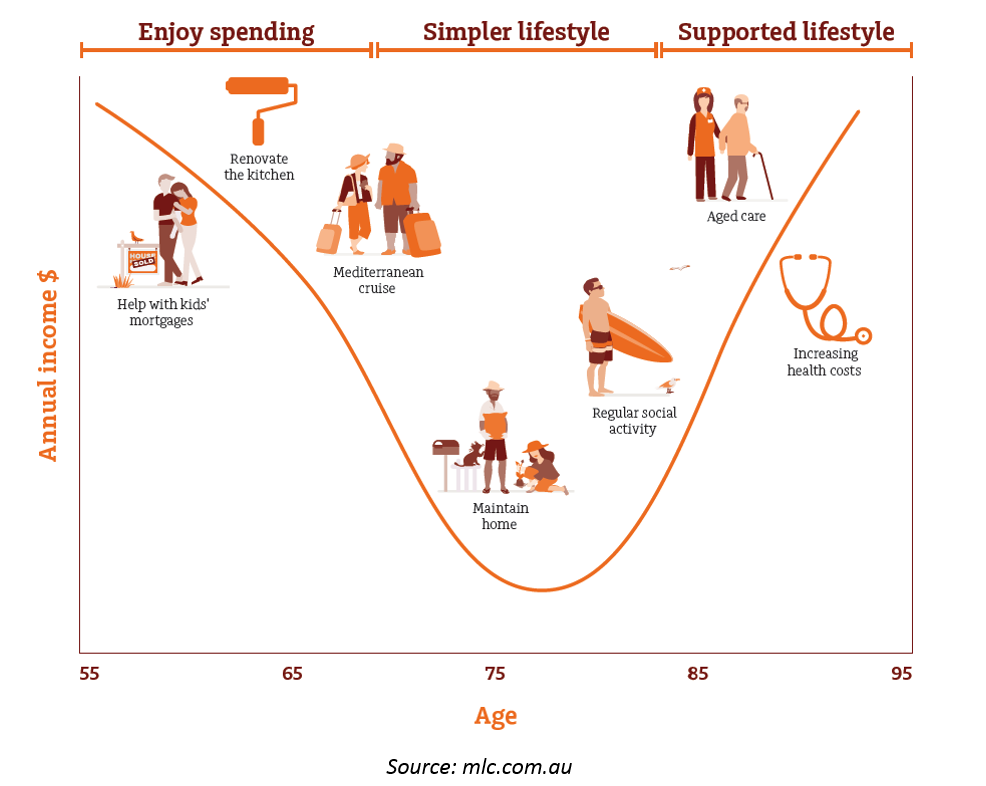

Most people believe that their annual spending will be lower at 60% to 80% of what they’ve spent previously. This assumption is unrealistic especially if you still have a mortgage or have unforeseen medical costs. We believe it should be closer to 100% because as a retiree, you will no longer be at work for 8 hours a day so you’ll have more time to travel, shop, start a new hobby, socialise and generally spend more.

One way to begin thinking about your needs is to visit the ASFA Retirement Standard which benchmarks the annual budget needed to fund either a modest or comfortable standard of living in retirement. According to ASFA, singles aged 65 would need around $27,913 a year to live a modest lifestyle while couples need $40,194. A comfortable lifestyle is estimated at $43,787 for singles and around $61,786 for couples.

Considering the full Age Pension is currently $24,268 a year for singles and $36,582 for couples, they are even below ASFA’s modest budget. It’s even more challenging if you still have a mortgage or rent, in addition to other expenses.

ASFA’s sample budgets are a good start to get you thinking about your likely costs on a weekly and annual basis.

Step 3: Find ways to save to fund it

Once you know how much your desired lifestyle will cost, it’s time to work out how you plan to save for it. On top of that, you also need to know how long your money needs to last.

For example, if the average life expectancy is 20 years from age 65, then that’s 20 years of income. Singles would need around $545,000 to fund a comfortable lifestyle of $43,787 a year while couples would need a lump sum of around $640,000 to fund a comfortable lifestyle of $61,786 a year (based on a 6% per annum return). So, if your preferred rate of return is lower than 6%, then you will need a bigger nest egg.

Check your superannuation balance, then add your assets outside of super, and then subtract your debts to arrive at your net savings. This will give you a good starting point to work out a savings strategy.

Once your strategy is set, you’ll need to invest it to grow. Will you invest in equities? What about managed funds? Cash? Maybe a combination? What’s important is that you know the projected return on your investments. If you’re 30+ years away from retirement, then your assets should be invested mostly in growth assets such as shares and property. If you’re less than 3 years away from retirement, then your portfolio should be focused more on income-producing assets and preservation of capital.

Are you close to making your retirement dream a reality?

Step 4: Plan for longevity

Australians are living longer, healthier lives. Your longevity needs to be considered when planning for retirement, so you don’t outlive your savings. If you want to retire early, it may mean running out of cash and having to depend on the Age Pension for the rest of your golden years.

Another difficulty is if you have a younger spouse who will likely be dependent on the income from the investment on your demise.

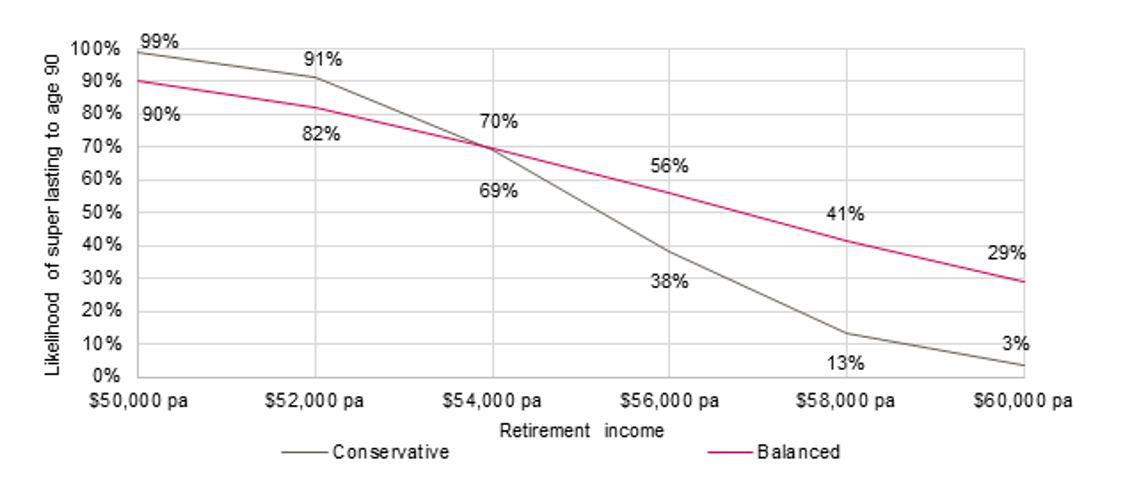

A big factor in the longevity of your retirement asset is your withdrawal rate. Estimating what your expenses will be in retirement is important because it will affect how much you withdraw each year and how you invest your portfolio. If you understate your expenses, you easily outlive your portfolio. But if you overstate your expenses, you risk not living the type of lifestyle you want in retirement.

Step 5: Are you on track?

To work out how much you are likely to have by the time you retire, you can use the ASIC MoneySmart online calculators to help you with this.

If there’s a gap between your retirement goal amount and your projected savings, you can always make additional contributions through salary sacrificing to superannuation or making after-tax contributions.

Alternatively, you can delay retiring to accumulate more money. You can also lower your expectations to have a more modest lifestyle. The choice is yours.

Everyone has different needs with their retirement income. The important thing is to start planning today. If you’ve already started planning your retirement with the JBS Team, you know you’re in safe hands. If not, you know there is still time to ensure you’re going in the right direction and you’re on track to meet your goals. Reach out to us here and let’s see how we can help!

Final word

Don’t fret. It can often take a bit of time to start planning. Think about your retirement goals. Think about how long the money needs to last. And keep saving. The great thing is, you’re now armed with the tools you need to work out how much you will need to finance the retirement lifestyle you want. All the best!