SMSF Investment Strategy Considerations

For those with a Self-Managed Super Fund (SMSF) you are required to prepare an Investment Strategy, when you initially set up your SMSF and you need to review it on a regular basis, with the industry standard being at least annually. You may also consider reviewing your investment strategy when there are changes in circumstances, for example a member entering pension phase, or a member making a large contribution into their fund. The main reason that an SMSF is required to have an investment strategy is to allow for the members personal circumstances to be regularly reviewed as well as, to account for any changes in the markets and economies.

The investment strategy is a way to prompt you as trustees to review your investment portfolio and ensure that it is still current given any changes that may have occurred in your personal circumstances or the markets and economies. It also helps you review your objectives, strategies and asset allocation to ensure that they’re still current and  may even prompt you to make changes where needed.

may even prompt you to make changes where needed.

When drafting an investment strategy there are a few key considerations that you should consider.

Liquidity Needs:

Each member’s personal circumstances and life-stages are an important factor with regards to the SMSF investment strategy. If each member is 15 years out of retirement, then you may consider investing for growth and riding out any volatility. However, if one or more members is approaching retirement or is in retirement, then you may need to use a more cautious approach to ensure that you can afford ongoing pension payments, but you may need to adopt some level of risk to help your super benefits last in retirement.

Risk Tolerance:

Each member may or may not have different tolerances to risk. Some may like or feel comfortable taking on additional risk in the hope of achieving greater returns, however others may feel more comfortable only taking on a small amount of risk and may feel better preserving their capital by investing in mainly cash and fixed interest. Either way, when reviewing your investment strategy and portfolio for your SMSF, you need to take into account each members risk tolerance.

Asset allocation:

The asset allocation of your SMSF portfolio needs to also be reviewed, especially alongside your risk tolerance, as you don’t want to be too overweight or too underweight in an asset class. However in some circumstances you may be comfortable with being over or underweight in an asset class. You may also review your asset allocation based on what’s happening in the markets or economies. For example, with the cash rate at all time lows, you may wish to seek returns and income from other asset classes, e.g. investing more in shares or international equity.

Insurance Needs of the Members:

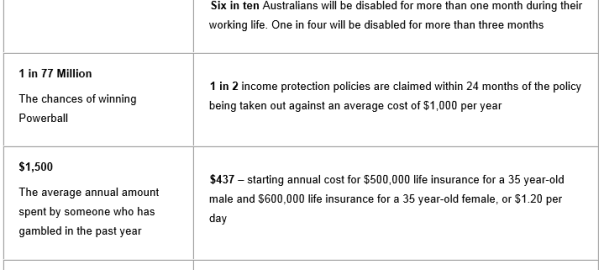

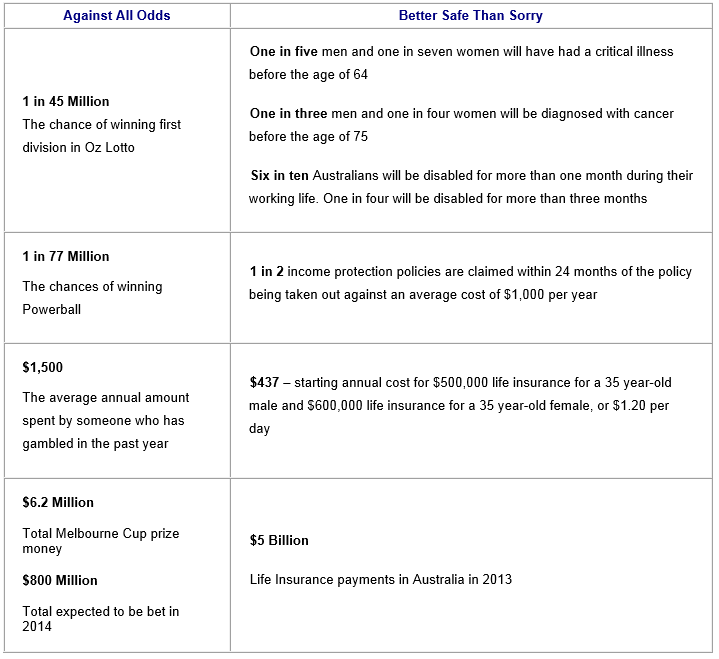

As trustees of your SMSF it is now a requirement that you must consider insurance as part of your Investment Strategy. It is not a requirement for each member to actually hold insurance but it needs to be clearly outlined that insurance has been considered for each member.

Here at JBS we can help you prepare your Investment Strategy and can even help review your current Investment Strategy.

This is set to change on 1st January 2015 when new ‘deeming’ rules come into effect for account based pensions meaning they will be subject to the same ‘deeming’ rules that apply to financial investments. All new account based pensions will be deemed as earning a certain rate of income regardless of the actual return of the investment. The current deeming rates are as follows:

This is set to change on 1st January 2015 when new ‘deeming’ rules come into effect for account based pensions meaning they will be subject to the same ‘deeming’ rules that apply to financial investments. All new account based pensions will be deemed as earning a certain rate of income regardless of the actual return of the investment. The current deeming rates are as follows:

Child Insurance can help you cover the extra financial burden of a serious illness, so you can do what ever it takes to get them healthy again.

Child Insurance can help you cover the extra financial burden of a serious illness, so you can do what ever it takes to get them healthy again.